Deployed on

Built with

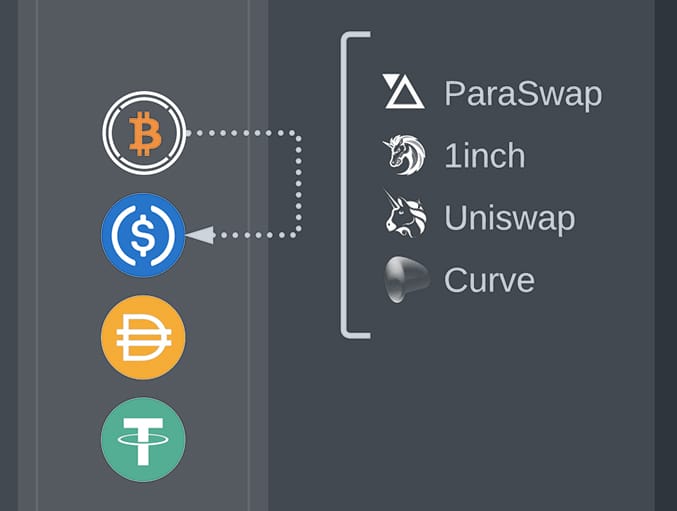

Swapping between

The

strategy to manage your Bitcoin.

By owning a token ($tWBTC) you can effortlessly automate the whole strategy.

Similar to ETF shares, but on-chain, you can always exchange your token for the belonging underlying assets at any time of your choosing.

Unleash the power of decentralization with smart contracts deployed on the Polygon blockchain.

No central authority needed. Equal access and interaction for all users. All swaps are public, executed through Paraswap, Uniswap V3 or Curve.

You maintain sole possession of your tokens, never entrusting them to any external entities. No centralized exchange intermediaries are involved.

A trustless smart contract facilitates the strategy automation, with your explicit consent.

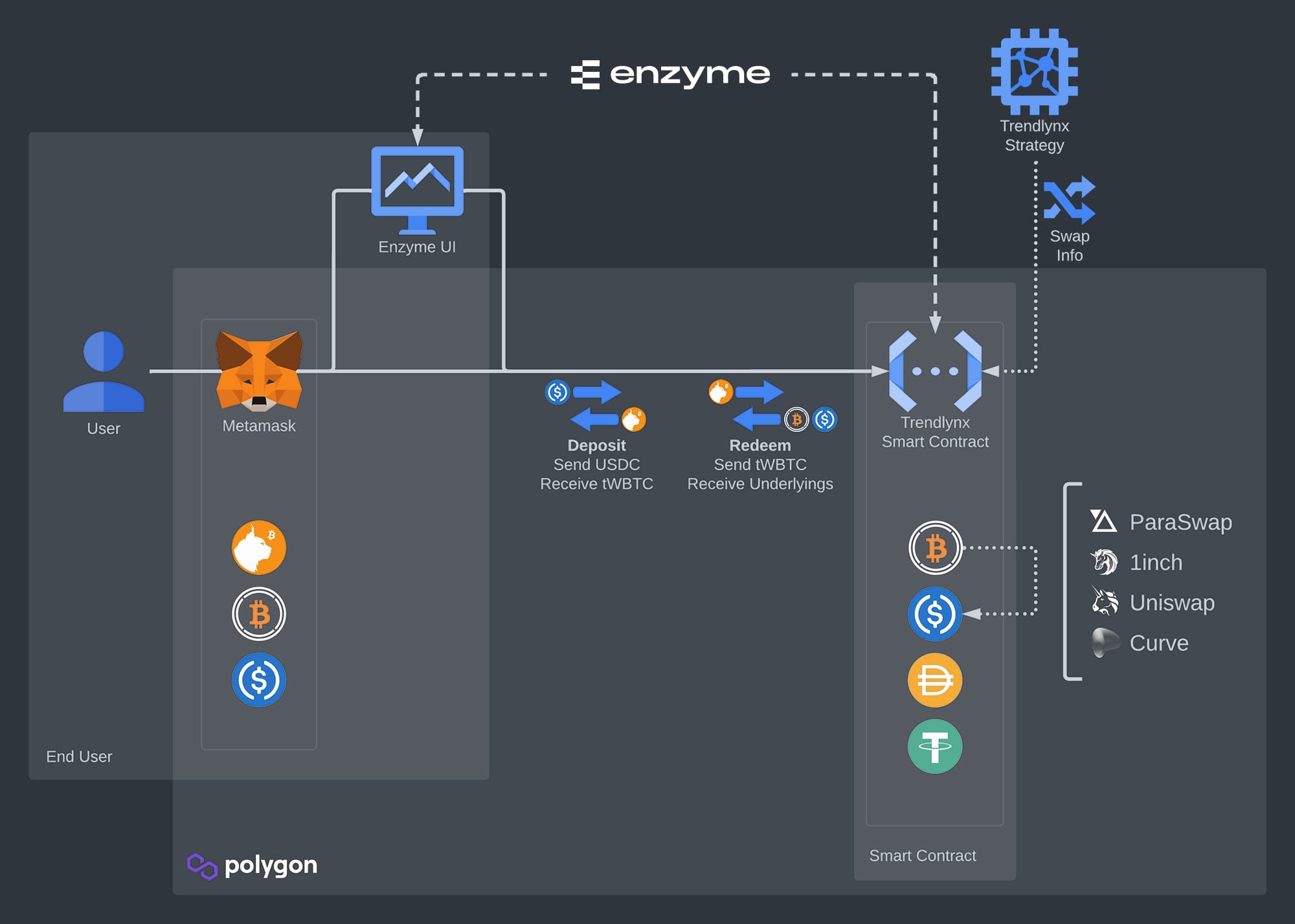

Enzyme is a protocol engineered to enable tokenized portfolio management with unparalleled security. Their audited contracts provide Trendlynx the most robust infrastructure to meet the highest standards.

That’s the foundational principle of both crypto and Trendlynx. All contracts and swaps are made public. Being a non-custodial and trustless service ensures the utmost transparency, giving you the ability to verify all actions and transactions.

tWBTC is minted by depositing the underlying assets onto the smart contract. tWBTC is burned by withdrawing the underlying assets from the smart contract. As with all ERC20 tokens, tWBTC can be traded, transferred, and securely stored.

Trendlynx is a publicly available tool that aims to optimize returns of a Bitcoin investment through superior risk management.

The following interactive charts demonstrate the historical performance of the strategy in relation to Bitcoin, Ethereum, and traditional benchmarks such as the S&P 500 and Gold. Enabling you to simulate various investment approaches, providing a comprehensive understanding of how past performance would have been. Data accounts for real-world factors such as slippage and fees.

The rate of return on an investment if it were held for one year, expressed as a percentage. It makes it easy to compare returns from different investments or time frames. Similar to Annual Percentage Yield (APY) measured in USD.

The downside of the strategy.

What you also need to know.

Like any investment, it has experienced periods of decline. By utilizing Trendlynx, you may undergo periods of subpar performance and losses. It is specifically tailored for long-term investors, premised on the belief that a long-term investment horizon yields the most favorable results. Enduring short-term declines is key to achieving higher returns.

The Trendlynx strategy is an advanced method of managing digital assets such as WBTC and USDC through the use of tWBTC tokens.

The most user-friendly way to get tWBTC tokens is to follow these 3 easy steps:

Create a Metamask wallet now (it's free), add the Polygon network and fund it with some MATIC. Metamask serves as the ideal storage solution for your funds within the ecosystem.

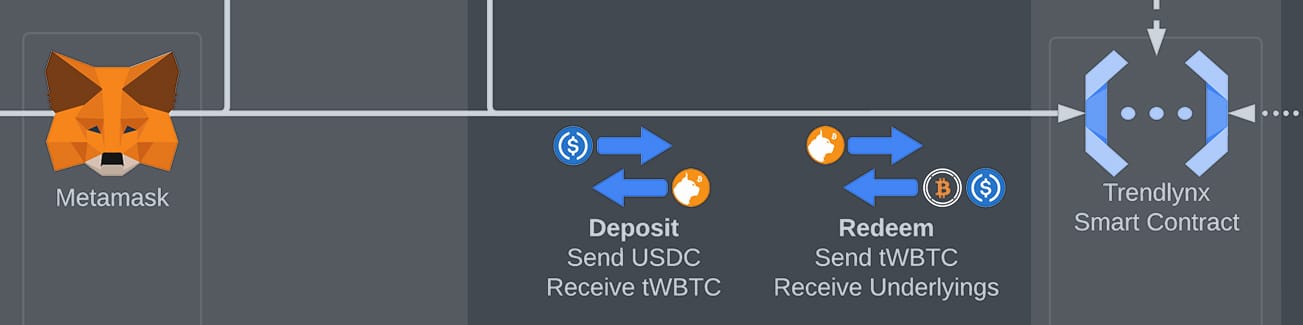

Interact with the tWBTC smart contract via the Enzyme UI. This interface allows for the execution of tWBTC Deposit and Redeem operations. Additionally, it provides real-time access to tWBTC performance metrics, underlying token allocations, and your updated account balance.

Proceed to Deposit the desired quantity of USDC. This transaction will allocate the specified amount into tWBTC, resulting in the transfer of the corresponding amount of tWBTC tokens directly to your Metamask wallet.

Don't forget to add the $tWBTC token to Metamask to view the updated balance.

The tWBTC tokens are backed by the underlying assets, meaning if the assets go up or down in value, tWBTC will do the same.

tWBTC tokens act as a form of access to the smart contract’s management capabilities and serve as a medium of exchange within the contract. The underlying assets remain locked within the smart contract and can only be retrieved by the user upon the burning of the tWBTC tokens, effectively relinquishing access to the smart contract’s management capabilities. This can be achieved with the Redeem button within the Enzyme UI.

The best-in-class framework to manage a tokenized strategy.

In order to utilize Trendlynx, users must employ a digital wallet such as Metamask, to store their tokens and interact with the Trendlynx smart contract on the Polygon blockchain. They can access the smart contract functions through the Enzyme user interface or by directly calling the smart contract functions. Both the user interface and smart contract structure are provided by Enzyme.finance (Avantgarde Finance Ltd.), which offers a secure framework.

A smart contract securing a completely collateralized system.

Users can call two functions:

Where users send tokens to the smart contract. The contract then creates a corresponding amount of tWBTC tokens based on current underlying token reserves and tWBTC token supply. The newly created tWBTC tokens are then sent to the user.

Where users send tWBTC tokens to the smart contract. The contract then returns the user a corresponding amount of underlying tokens based on current underlying token reserves and tWBTC token supply. The sent tWBTC tokens are burned.

This process of creating and burning tWBTC tokens ensures that there is a direct relationship between the number of tWBTC tokens in circulation and the amount of underlying tokens held by the smart contract. This results in a fully collateralized system where there is no token sale and users are only able to exchange their underlying tokens for tWBTC tokens, and vice versa.

Transparent swapping with unmatched efficiency.

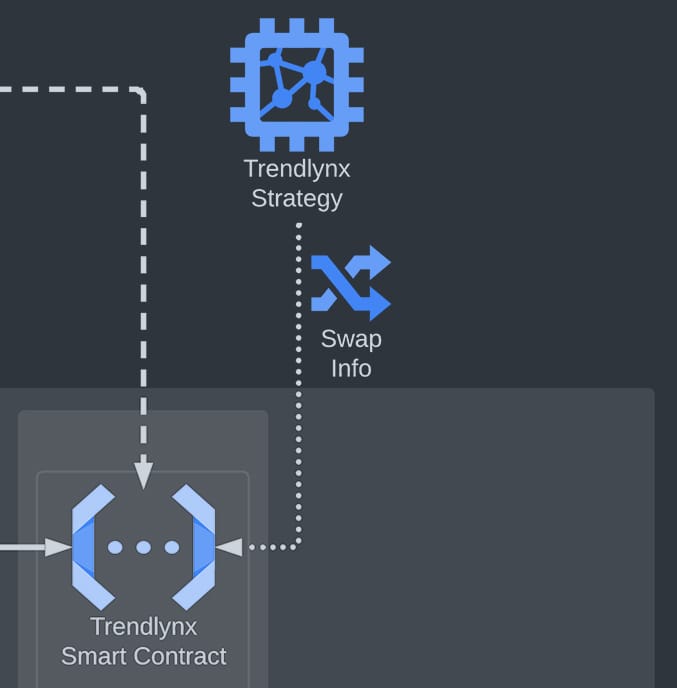

The smart contract can only accept instructions to swap underlying tokens from Trendlynx’s private addresses. These swap orders are public and follow the strategy outlined on the website.

This swapping capability allows the underlying token value to fluctuate, which is the sole factor that impacts the tWBTC token price.

Swaps are executed at the best rate found accross ParaSwap, 1inch, Uniswap and Curve, which combined aggregate 100+ exchanges ensuring optimal execution and pricing.

Non-custodial. Decentralized. 100% Automated.

tWBTC tokens allow Trendlynx to be non-custodial, meaning Trendlynx does not hold on to users tokens, but instead operate via automated functions that promote decentralization and fairness. With Trendlynx, users remain in control of their assets by receiving tWBTC tokens in return for providing tokens like WBTC to the smart contract, which is managed by code and not by human operation. tWBTC tokens represent a user share of the underlying tokens held in the smart contract, and users remain entirely in control of the token.